Indian Subsidiary Company

Indian Subsidiary Company Registration: Starting Your Business the Right Way

Welcome to our comprehensive guide on subsidiary company registration in India. Setting up a subsidiary company in India can open up new opportunities for domestic and foreign businesses alike. Whether you're an Indian company looking to expand your operations or a foreign entity seeking to establish a presence in India, this guide will provide you with a step-by-step overview of the registration process, legal requirements, and key considerations to ensure a smooth and successful establishment of your subsidiary company.

Subsidiary Company Registration

To register a subsidiary company in India, businesses must comply with the legal requirements set forth by the Ministry of Corporate Affairs (MCA). These requirements involve choosing an appropriate business structure, obtaining necessary approvals, and adhering to statutory compliances.

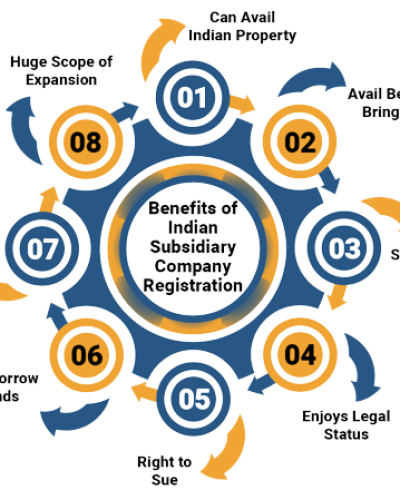

Advantages of Establishing a Subsidiary Company in India

Setting up a subsidiary company in India presents several advantages. These include limited liability, access to a vast consumer market, ease of doing business, repatriation of profits, tax benefits, and more. By establishing a subsidiary, businesses can expand their reach, enter new sectors, and tap into India’s dynamic economy.

Taxation Aspects of Subsidiary Companies in India

Understanding the taxation aspects of subsidiary companies in India is crucial. This section provides an overview of corporate tax rates, tax incentives, transfer pricing regulations, withholding taxes, and other tax-related considerations that subsidiary companies must be aware of to ensure compliance and optimize tax planning.

Foreign Subsidiary Company Registration

Registering your partnership business is crucial to operate legally. It also provides various benefits like opening a bank account, obtaining loans, entering into contracts, and obtaining licenses and permits. Partnership business registration provides legal protection to the partners’ personal assets and liabilities.

Register Subsidiary company in India

This section outlines the step-by-step process for registering a subsidiary company in India. It covers choosing a business structure, obtaining digital signature certificates and director identification numbers, reserving a unique company name, preparing incorporation documents, paying fees, obtaining the certificate of incorporation, and fulfilling post-registration requirements such as obtaining PAN, TAN, and opening a bank account.

Sign up to our newsletter

Receive latest news, updates and many other news every week.